Semiconductor sector entering golden age

An executive of Huawei introduces its Mate Xs mobile phone, which is installed with the company's own processor chips, at a news conference in Shenzhen, Guangdong province, on Oct 23, 2019. [Photo/Xinhua]

Large-scale rollout of 5G networks and nation's push to cultivate local chip suppliers to inject new vitality into industry

China's domestic semiconductor sector is entering a golden age for development, as the upcoming large-scale rollout of 5G networks and local Chinese tech giants' push to cultivate local chip suppliers combine to inject a new vitality into the industry, experts and business executives said.

Such enthusiasm is also fueled by the broader trend of Chinese companies' efforts to reduce reliance on the foreign semiconductor industry amid global geopolitical uncertainty, they added.

Huang Qing, China managing director of Walden International, a US venture capital company focused on cross-border investments, said: "As some countries move to tighten control of key technologies including premium processors, China is facing an unprecedented opportunity to build up its chip capabilities."

China has the world's leading system integration companies in mobile phones, 5G communications, security and other areas. They traditionally tend to cooperate with European and US suppliers.

But as the US government moves to impose export controls on Chinese technology firms, they have begun to feel an urgent need to work with domestic semiconductor companies, Huang said.

"By serving such tech giants, Chinese chip companies have an unprecedented opportunity to grow into global players," Huang said, adding that the country now uses more than half of the world's semiconductors.

Last year, Washington put a string of Chinese tech and artificial intelligence pioneers, including Huawei Technologies Co, on its Entity List, which restricts them from buying crucial US technologies including chips and processors used in smartphones, computers, servers and other areas.

Such a move has prompted the banned Chinese tech companies to step up their push to nurture local chip suppliers and beef up their own semiconductor manufacturing prowess.

An increasing number of Chinese smartphone vendors, for instance, are marching into the chip sector, after realizing the importance of in-house research and development capabilities for the semiconductor sector.

Vivo, a major smartphone vendor, joined hands with South Korean tech giant Samsung to unveil a 5G chip in November, marking the former's latest push to showcase its increasing emphasis on enhanced research and development capabilities.

Smartphone makers Xiaomi Corp and Oppo are also intensifying their inputs in the sector, with the former investing in a string of chip design startups, and the latter recruiting chip professionals to beef up its smartphone design department.

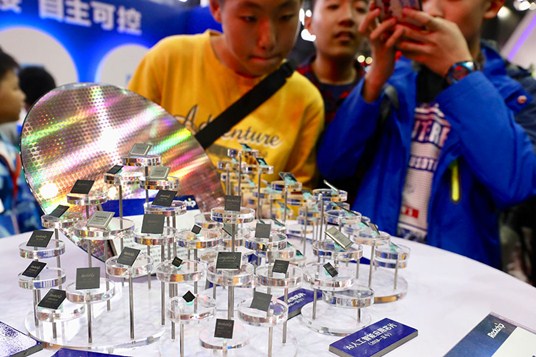

Visitors look at made-in-China chips during a digital products exhibition in Fuzhou, capital of Fujian province, on May 6, 2019. [Photo by Zhu Xingxin/China Daily]

"The wider use of 5G and the increasing popularity of the internet of things applications will give rise to a new wave of chip companies that can meet more diversified demands," said Xiang Ligang, a telecom veteran and director-general of the Information Consumption Alliance's telecom industry association.

China's chip industry has made rapid strides in the past decade. In 2018, the country's indigenous chip sector recorded 653.2 billion yuan ($93.3 billion) in sales revenue, up 20.7 percent from a year earlier, faster than the global average, data from the China Semiconductor Industry Association showed.

But as the world's largest semiconductor market, China still spends more on importing chips than on importing crude oil imports. In 2018, its chip imports exceeded $300 billion for the first time, up from $260 billion in 2017, according to data from the Ministry of Industry and Information Technology.

Experts stressed that a prudent, open and practical approach is also needed to ensure healthy development of the domestic semiconductor sector.

Ding Wenwu, president of the China Integrated Circuit Industry Investment Fund Co Ltd, said chip design has become a focus area for investors as it has a lower technological threshold and generates quicker returns on their investments. But, in fact, more efforts are needed to bankroll the chip material, equipment and manufacturing segments, he said.

"Currently, investors are interested in the chip industry, but it is important to ensure the right investment direction. It is important not to put all the money into semiconductor design. China is lagging behind advanced countries in chip material, equipment and manufacturing, all of which need heavy resource inputs," Ding said.

According to him, only with a balanced growth in all of the above areas can China's domestic semiconductor industry achieve sustainable development. The China Integrated Circuit Industry Investment Fund Co Ltd was established in 2014 with its first phase of capital exceeding 138.7 billion yuan from State and private investors. The fund has finished raising the second round of capital and it is making new investments.

Diao Shijing, co-president of Tsinghua Unigroup, the leading chipmaker in China, said semiconductor manufacturing is highly capital-intensive and requires superlong investment cycles.

"The government should help attract more money into chip manufacturing and let investors know that it is a profitable business, though it is not like chip design where money comes and goes faster," said Diao, who was also a former senior official with the Ministry of Industry and Information Technology, the country's top industry regulator.

Another problem is that China lacks an adequate number of professionals with expertise in chip technologies. In recent years, many semiconductor professionals have moved to internet companies where wages are far higher.

Data from the China Center for Information Industry Development showed that China needs around 720,000 chip experts. But, by the end of 2017, it had only about 400,000.

"The shortage of semiconductor professionals is the biggest bottleneck for China's chip sector," said Zhu Yiming, chairman of ChangXin Memory Inc, which has mass-produced China's first DRAM chips last year. DRAM is a type of high-end processor widely used in smartphones and personal computers.

To partly solve the problem, ChangXin Memory built its plant in Hefei, capital of Anhui province, which is home to the premier University of Science and Technology of China and a branch of the Chinese Academy of Sciences.

ChangXin Memory is now building chip production bases with total investment of no less than 150 billion yuan. The first phase of the plant has already been finished, with a designed monthly production volume of 120,000 wafers.

A former employee at the US chip behemoth Intel Corp said the chip sector is characterized by a specific division of labor. Chip firms should step up efforts to help employees develop comprehensive capabilities to better retain them.