Kuaishou Technology announces details of the proposed listing on the Main Board of The Stock Exchange of Hong Kong

Kuaishou Technology ("Kuaishou", together with its subsidiaries and consolidated affiliated entities, the "Group"), a leading content community and social platform, today announced the details of its global offering of shares (the "Global Offering") and its proposed listing on the Main Board of The Stock Exchange of Hong Kong Limited ("HKEX").

Offering details

The Group intends to offer an aggregate of 365,218,600 shares (subject to the Over-allotment Option) (the "Offer Shares"), of which 356,088,100 shares (subject to re-allocation, adjustment and the Over-allotment Option) will be for International Offering and 9,130,500 shares (subject to reallocation and adjustment) will be for Hong Kong Public Offering. Indicative Offer Price ranges between HK$105.00 and HK$115.00 per Offer Share. Assuming the Over-allotment Option is not exercised and an Offer Price is set at HK$110.00 per share (being the mid-point of the Offer Price range), the estimated net proceeds from the Global Offering will amount to approximately HK$39,477.4 million after deducting underwriting commissions and other estimated expenses in connection with the Global Offering.

The Hong Kong Public Offering will begin at 9:00 a.m. on 26 January 2021 (Tuesday) and will end at 12:00 noon on 29 January 2021 (Friday). The final Offer Price and allocation results will be announced on 4 February 2021 (Thursday). Dealing in Kuaishou's Class B shares will commence on the Main Board of HKEX on 5 February 2021 (Friday) under the stock code 1024. The Class B Shares will be traded in board lots of 100 Class B Shares each.

Morgan Stanley Asia Limited, Merrill Lynch Far East Limited, and China Renaissance Securities (Hong Kong) Limited are the Joint Sponsors. Morgan Stanley Asia Limited, Merrill Lynch (Asia Pacific) Limited and China Renaissance Securities (Hong Kong) Limited are the Joint Global Coordinators. Morgan Stanley Asia Limited, (in relation to Hong Kong Public Offering only), Morgan Stanley & Co. International plc (in relation to International Offering only), Merrill Lynch (Asia Pacific) Limited, China Renaissance Securities (Hong Kong) Limited, The Hong Kong and Shanghai Banking Corporation Limited, ICBC International Capital Limited (Joint Bookrunner only), ICBC International Securities Limited (Joint Lead Manager only), Haitong International Securities Company Limited, CMB International Capital Limited, BOCI Asia Limited and Futu Securities International (Hong Kong) Limited are the Joint Bookrunners and Joint Lead Managers of the Listing.

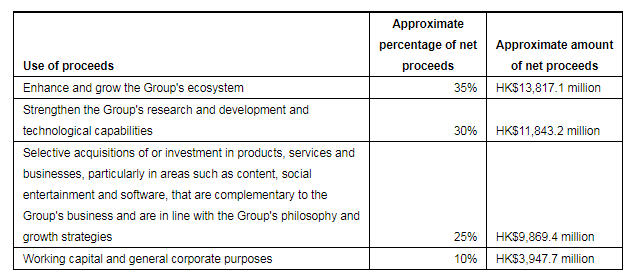

Use of proceeds

Assuming that the Over-allotment Option is not exercised and the Offer Price is set at HK$110.00 per Offer Share, (being the mid-point of the indicative price range between HK$105.00 and HK$115.00), the Group estimates the net proceeds from the Global Offering, after deducting related underwriting fees and estimated expenses in connection with the Global Offering, will be approximately HK$39,477.4 million, the Group intends to use the net proceeds for the following purposes:

Investment highlights

Dedication to an authentic user experience encourages interactions and content creation

Kuaishou helps everyday people express themselves. Based on its technology infrastructure and personalization engine, Kuaishou has established a unique online traffic allocation mechanism that gives people the chance to be seen, understood, and for their lives to be embraced by others. After being seen, users will be able to be connected with a group of followers who understand, like and resonate with them, which reinforces the interactions on the platform.

This is best shown by the fact that nearly 40% of the short videos on Kuaishou App had more than 100 accumulated views [4] and content creators constitute approximately 26% of its average MAUs.

Interest-based Community with a Highly Engaged User Base and a Vibrant Ecosystem

Content on Kuaishou's platform covers a wide range of topics, and it is home to many interest groups. Kuaishou's deep and diverse content motivates content creators to keep creating authentic and original content. By doing this, Kuaishou benefits from strong network effects and is able to attract more and more users to its platform. This virtuous cycle of content creation and consumption also increases user engagement.

For the nine months ended September 30, 2020, DAUs on average spent over 86 minutes per day on Kuaishou App and accessed it more than 10 times a day. In the nine months ended September 30, 2020, the Group had approximately 1.1 billion average monthly short video uploads and nearly 1.4 billion live streaming sessions hosted on Kuaishou App, with 2.2 trillion likes, 173 billion comments and 9 billion shares recorded on short videos and live streams. As a result of the robust engagement, its content base is growing rapidly and organically.

Industry-leading technologies enhance user engagement

Kuaishou has invested heavily in data and technology infrastructure, with over 6,500 R&D employees as of September 30, 2020. Its deep reinforcement learning-based personalization engine is built for short video and live streaming content recommendations. Its personalization engine allows Kuaishou to keep users engaged with interesting and useful content and connects them with content creators based on their common interests.

Multifaceted network effects

Kuaishou's business growth naturally gives rise to multifaceted network effects on its platform. Kuaishou has become the starting point and platform for content creation and business activities. The more users use Kuaishou App, the more diverse and vibrant its ecosystem becomes, which increases user engagement and the value it provides to ecosystem participants. Also, users' interactions and trust greatly enhance monetization. This in turn attracts more advertisers, merchants and other business partners to its platform. In addition, this virtuous cycle is supported by massive data and Kuaishou's technology. All participants on Kuaishou's platform have created massive data, enabling it to understand users better and provide more convenient & efficient transactions.

Diverse monetization opportunities arise naturally

Kuaishou takes a unique approach to monetization and expansion into new business lines. At Kuaishou, all business lines are integrated and grow naturally based on the value users get from them. Kuaishou gradually added tools to facilitate these interactions to take place. Different business lines integrated in the community and propelled each other.

Kuaishou has several business lines that promote and influence each other, including live streaming, online marketing services and other services which include e-commerce, online games and other value-added services.

Visionary management and reputable shareholders

The Group's management team pioneered the short video and live streaming platform model globally. Its co-founders Mr. Su Hua and Mr. Cheng Yixiao are visionaries who envisioned the market potential of content-based social platforms, and have a complementary combination of product and engineering expertise.

Kuaishou's management team has a steadfast dedication to its mission and core values, always putting users first and relentlessly focusing on satisfying their needs and exceeding their expectations. The fundamental measure of Kuaishou's success is the value the Group creates for its ecosystem participants and society over the span of multiple decades. Kuaishou is accountable to its users to continue to improve itself, pursue long-term success over short-term interests, and contribute to the overall happiness of its society.