SM: driving growth through sustainability and governance

SM Investments Corporation (SM Investments), a leading conglomerate in the Philippines, is committed to sustainable expansion and good governance, fostering a network of businesses that aligns with its founder, Henry Sy, Sr.'s belief that business growth and social development go hand in hand.

Through one of SM Store's Shop & Share initiatives with Mastercard, SM Foundation is able to extend its college scholarship program to women pursuing studies in the field of STEM.

At the heart of the SM group's sustainability strategy are two guiding principles: relevance and meaningful impact. These principles ensure that stakeholders can grow alongside the company and experience the benefits of this growth.

SM's sustainability journey began in the 1950s with a small shoe store in Downtown Manila, which recognized local suppliers as essential partners. In response to the socio-economic challenges of the 1980s, SM established the SM Foundation to provide access to essential services, including education, healthcare, and food security.

SM establishes the SM Foundation to provide access to essential services, including education, healthcare, and food security.

SM Investments President and CEO Frederic C. DyBuncio emphasizes the importance of addressing socio-economic disparities: "A widening gap poses risks to an economy striving for sustainability. We must allocate resources to enhance access to vital services like food security, education, and healthcare."

SM Investments President and CEO Frederic C. DyBuncio

SM's real-estate arm, SM Prime Holdings recognized the need for companies and communities to be resilient against disasters, incorporating climate adaptation measures in SM infrastructure designs and soft skills training in people and communities.

Another example is the Philippines' need for more affordable, reliable and renewable energy. SM's banking arm, BDO Unibank now serves as one of the largest funders of renewable energy projects. As of December 31, 2023, BDO funded 898 billion Philippine pesos ($15.3 billion) in sustainable finance, including loans to help finance 59 renewable energy projects.

To promote circularity towards green energy production, SM Prime recently unveiled its waste-to-fuel partnership with GUUN Co. Ltd. (GUNN) to implement the Japanese technique of reducing landfill impact. The technology converts non-recyclable and hard-to-recycle packaging into alternative fuel.

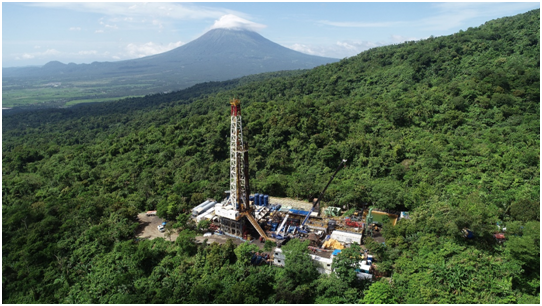

While SM's properties shift to renewable energy, what creates impact to Philippine communities is more renewable energy sources. SM acquired Philippine Geothermal Production Company, a pioneer in geothermal development in Southeast Asia.

Philippine Geothermal Production Company (PGPC) is a pioneer in geothermal development in Southeast Asia.

Investors are now paying more attention to the board make-up of corporates and how this will further ensure sound practices to support sustainable growth.

An independent view and the professionalization of the board are gaining importance, which also helps in managing the equitable treatment of all stakeholders and providing the necessary checks and balances.

In SM's case, recent governance moves have stood out among peers in Asia.

The appointment of independent director and two-term Bangko Sentral ng Pilipinas Governor Amando M. Tetangco, Jr. as Chairman of the Board of SM Investments Corporation in 2023 was a first in the company's history, upholding the highest standards of corporate governance by going beyond mere compliance.

Focusing on professionalization, accountability, sustainability and transparency, SM has been raising the bar on good corporate governance whilst promoting independent judgment and independent leadership.

Recently, SM moved to increase the size of its board to give more than majority, five out of nine seats, to independent directors.

Notably, out of the five independent directors, two are female and overall female representation in the board consists of a third of the total board members. A diverse board further complements the thrust towards independent leadership and judgment, transparency, accountability, fairness and professionalism ensuring interests of various stakeholders are considered in board decisions and strategies.

On top of this, SM's Related Party Transactions Committee is composed entirely of independent directors with the right to review any transaction or related relationship in the group.

SM Investments practices good corporate governance in all its dealings with all stakeholders, investors, business partners, creditors, customers and employees because it believes that good corporate governance will provide long-term growth, sustainability and success.