Cross-border RMB settlement makes low-cost funds available in Shanghai FTZ

A SPD Bank logo is seen on a building in Shanghai, May 20, 2019. [Photo/IC]

Shanghai Pudong Development (SPD) Bank recently handled the first cross-border RMB financing settlement business for the Shanghai branch of a large-scale foreign bank, which ranks among the world's top ten banks.

This is the first time that SPD Bank has provided such kind of services for a foreign bank, providing an important channel for the foreign bank to borrow low-cost funds from overseas in the future and effectively reduce its financing costs.

The foreign bank's Shanghai branch had an urgent need to bring in RMB from overseas joint banks to expand its RMB business and ease the shortage of liquidity.

However, the bank had not joined the modern RMB payment system in China, so the RMB receipt and payment business could not be carried out smoothly.

When learning about the situation, SPD Bank immediately formulated the plan to open a cross-border RMB clearing account for the bank and assist in confirming the requirements for data submission.

To date, the bank has been able to integrate funds from overseas through the newly opened account, enabling them to receive and pay RMB in China.

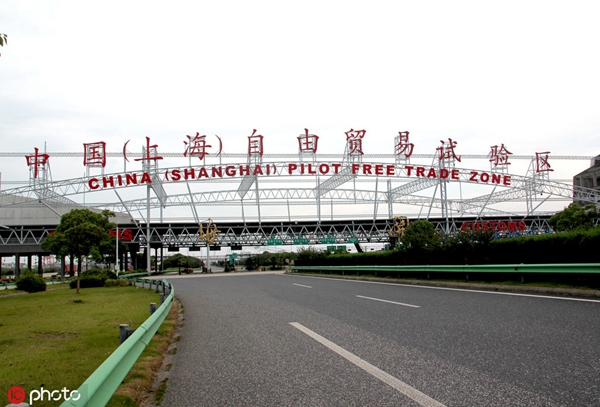

The China (Shanghai) Pilot Free Trade Zone. [Photo/IC]

In order to broaden the financing channels for financial institutions and enterprises, the People's Bank of China has supported the macro prudential management of overseas financing and cross-border capital flows for the pilot ledger accounting business in the China (Shanghai) Pilot Free Trade Zone.

The move will help domestic institutions make full use of low-cost funds, as well as improve financing autonomy and capital utilization efficiency.

As the Notice on Matters Concerning Macro prudential Management of Full-Scale Cross-border Financing was issued, the experience of the free trade zone was replicated and promoted across the country, enabling domestic financial institutions and enterprises to borrow low-cost funds from abroad to effectively reduce financing costs.

This is how the foreign bank's Shanghai branch was able to open a cross-border RMB settlement account at SPD Bank.

According to SPD Bank, inter-bank cooperation is a key area for the bank to seek breakthroughs by taking advantage of the platform of the Shanghai FTZ.

In addition to conventional products such as inter-bank deposits and inter-bank financial management, the bank has also promoted gold international board agency settlement service and cross-border financing settlement, striving to better serve Shanghai's goal of building an international financial center.

Foreign investors have faith in China

Foreign investors have faith in China  The RCEP era begins

The RCEP era begins  Yangtze River Delta integration: 3 years on

Yangtze River Delta integration: 3 years on  play

play