The Establishment of Foreign Investment Enterprises

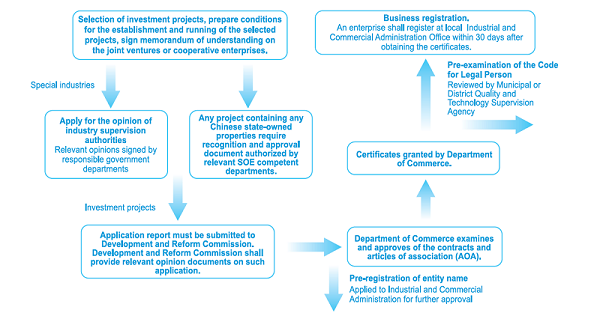

Flow chart of establishing foreign investment projects under joint ventures, cooperative enterprises, foreign-funded enterprises and other types of ownership [Photo/igd.gdcom.gov.cn]

1. Examination, approval and filing of the projects

Foreign investment projects in Guangdong province shall be examined, approved and filed, pursuant to the requirements stated in a series of documents, including the Notification of the State Council on Measures to Expand Opening-up and Utilizing Foreign Investments, the Notification of the State Council on Measures to Promote the Growth of Foreign Investment, the Notification of the State Council on Releasing the Catalogue of Investment Projects Approved by the Government (2016), Catalogue of Industries for Guiding Foreign Investment (Revision 2017), Guidelines on the Examination, Approval and Reporting-based Management of Foreign Investment Projects issued by National Development and Reform Council, Regulations on the Examination, Approval and Reporting-based Management of Entity Investment Projects issued by the State Council in 2016 and Notification of People’s Government of Guangdong Province on Issuing Opinions on Implementing List-based Management for Entity Investment Projects in Guangdong Province (Trial).

Examination, approval and filing of changes to approved projects:

Should the approved or filed projects undergo any of the changes stated below, the entity shall apply for changes to the authority that approved the projects.

(1) Changes in place of the projects.

(2) Changes in investors or equity structures of the projects;

(3) Changes in major construction contents of the projects;

(4) Other changes as required by relevant laws and regulations and industrial policies.

2. Pre-Approval and Registration of the Names of the Entities

Before signing the contracts, foreign investment entities shall apply for pre-approval and registration of the names of their entities at Industrial and Commercial Administrative authorities.

Note: pursuant to relevant laws and regulations, the full names of entities are usually expressed in the following form: the administrative division + the given name of the entity + industry (operation features) + organizational form.

Foreign investment entities that apply for pre-approval and registration of their names may download the application forms by logging in on the website of Guangdong Province Administration for Industry and Commerce.

Attention:

(1) Validity of the names

The names of the entities that have been pre-examined and approved have the validity period of six months, and the names will expire at the end of 6 months after pre-approval. During the validity period, the pre-examined and approved names shall not be applied for any operational purposes or transferred.

(2) Extending the validity of the names

Within 30 days before the pre-examined and approved names expire, applicants may apply to extend the validity of the names at the registration office with Note on Pre-examination and Approval of Names of Entities or Note on Pre-examination and Approval of Changes in Names of Entities.

For extension of the validity of the names of entities, an Application Form for Extending the Validity of Pre-examined and Approved Names of Entities signed by all investors must be provided. The validity of the names will be extended by 6 months, after which there will be no more extension allowed.

3. The Establishment and Changes of Foreign Investment Entities

Foreign investment enterprises that are not subject to special entry control implemented by the government will be administered on a filing basis.

The special entry control of foreign investment is comprised of controls stipulated in catalogue of industries that restrict and prohibit foreign investment in Catalogue for the Guidance of Foreign Investment Industries (Amended in 2017), restrictive measures implemented on both domestic and foreign investment enterprises and other restrictive stipulations specified in international treaties, laws and regulations that China has signed or participated in. Enterprises established in China through mergers and acquisitions by enterprises that are legally established or controlled overseas by Chinese enterprises or natural persons shall be governed by existing provisions.

4. Business Registration

A new registration system for entities was launched on Sept 1, 2017, which has replaced the redundant necessity of a business registration, an organization code certificate and a tax registration certificate with only a business registration and a unified social credit code. Business and market supervision authorities will approve of and produce business licenses with a unified social credit code for legal people and other social organizations. Business licenses, organization codes, tax registration certificates, social security registrations, statistics registration certificates have been combined and given a unified code for entities (including corporations, non-corporate enterprise legal persons, sole proprietorships, partnerships and other market bodies and their branches) and farmers’ specialized cooperatives. On this basis, registrations and filing of housing fund deposits, establishments of foreign investment entities, foreign trader dealers, international freight forwarding entities, inspection and quarantine reporting entities and applicant entities of Certificates of Origin are integrated. The business licenses and tax registration certificates of sole proprietorships have been integrated, and given that, registrations and reporting of housing fund deposits and foreign trader dealers for sole proprietorships have also been integrated. The certificates and licenses eliminated during such integration will not be issued anymore except for those specially applied by entities, farmers’ specialized cooperatives or sole proprietorships.

5. Foreign Exchange Management

The State Administration of Foreign Exchange has strived to regulate management of foreign exchange in foreign direct investment and improve management efficiency by further deepening the reforms on management of foreign exchange in capital account and facilitating the transnational capital operation of entities. To this end, it is decided that, since 1st of June, 2015, a series of administrative examinations and approval procedure has been removed for foreign investment activities in China, such as registration, examination and approval of matters related to foreign currencies. Instead, such matters shall be dealt with by banks pursuant to the Notifications of the State Administration of Foreign Exchange on Further Simplify and Improving Policies on the Management of Foreign Exchanges in Foreign Direct Investment and its attachment document of Guidance on Foreign Exchanges Operations in Direct Foreign Investment.

Foreign investment, foreign-funded banks, non-bank financial institutions and/or foreign direct investment enterprises both in and out of the jurisdiction of the State Administration of Foreign Exchange are required to entrust their accountant firms or banks to report the outstanding foreign direct investment in China by the end of last year and/or the amount of surplus equity in foreign direct investment registered in their accounts by June 30th every year on the online service platform of the State Administration of Foreign Exchange. Any market bodies that fail to report such information pursuant to relevant regulations will be regulated, in terms of their businesses, by the State Administration of Foreign Exchange by means of its capital account information system, and the bank will not provide any foreign exchange services under the capital account for such entities. If such market bodies cannot give justified reasons on their failure to file the required information, they will be administratively punished pursuant to relevant laws and regulations.

6. Tax Management

Business and market supervision authorities will approve of and produce business licenses with a unified social credit code for legal people and other social organizations, and business will not have to acquire a separate tax registration certificate. When dealing with tax-related matters, entities may use the new business licenses with the unified code on it as the original tax registration certificates after their additional information is collected.

Business registration and business licenses combined equal a tax registration certificate, and within 15 days after finishing these procedures, entities shall file their financial and accounting systems or accounting treatment methods to the tax authorities; they shall also file all their bank accounts to local tax bureaus within 15 days after they open the accounts with the bank, and then make tax declarations pursuant to relevant laws and regulations. Entities that need to make declarations online may go to local tax bureaus to apply for online electric tax declaration services.

(This English version is only for reference. To learn more, please refer to the authoritative Chinese version on igd.gdcom.gov.cn)