Financial services to buoy China-ASEAN trade ties

Enhanced development of diversified financial services will play a big role in enhancing trade, investment ties between China and the Association of South East Asian Nations, officials said.

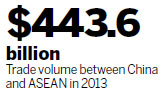

China and the ASEAN bloc have witnessed a golden period in trade and investment since 2002, when the two sides first agreed to set up a free trade zone. Bilateral trade increased from $100 billion in 2004 to $443.6 billion in 2013, with China the largest trade partner of ASEAN, according to data provided by the Ministry of Commerce.

"Enhanced financial services will facilitate the future development of trade, investment ties between China and ASEAN," said Wang Lei, deputy secretary-general of the secretariat department of the China-ASEAN Expo.

To meet the growing demand for financial services, the China-ASEAN Expo, which is held annually in Nanning, the capital of the Guangxi Zhuang autonomous region, has set up a special exhibition area for financial services and finance-themed forums since 2009.

"The increased trade and investment activities between China and ASEAN have helped propel regional financial cooperation between the two sides," said Wang.

Since 2010 when Guangxi was approved as a pilot region for yuan trade settlement with ASEAN, a number of finance cooperation projects have been inked, sources with the Guangxi regional government said.

By the end of 2013, Guangxi handled cross-border yuan trade settlements worth more than 213.5 billion yuan ($34.76 billion), the sources said.

As one of the country's southern gateways to ASEAN, Guangxi is banking on the growth of its financial services industry to facilitate more trade with ASEAN members, said Zhang Xiaoqin, vice chairman of Guangxi Zhuang autonomous region. "More convenient financial services, will facilitate trade," he said.

According to Zhang, a comprehensive pilot reform scheme for cross-border finance cooperation in Southwest China was approved in 2013.

The Yunnan-Guangxi border pilot zone for comprehensive financial reforms, approved by the People's Bank of China, the central bank, in November last year, aims to cultivate innovation in cross-border renminbi settlement with ASEAN nations and improve local financial systems.

Under the scheme, Guangxi has mapped out a finance reform area covering 31.77 square kilometers. The area includes cities of Nanning, Qinzhou, Beihai, Fangchenggang, Baise and Chongzuo, which are situated in frontline of China-ASEAN cooperation areas.

In Nanning, a new regional development area featuring financial services is under construction, with the local city government issuing a series of policies to support industries and trade.

In Fangchenggang, which neighbors Vietnam, a currency trade information platform has been set up at the Dongxing Development Pilot Zone, allowing inter-bank listed trading of the renminbi and currencies of the neighboring ASEAN countries.

qiuquanlin@chinadaily.com.cn

(China Daily 09/09/2014 page17)

Why Xiamen

-

Xiamen is one of the most economically competitive cities in China and was one of the first Special Economic Zones on the Chinese mainland. As a vice-provincial city independently listed on the State development plan, it has provincial-level authority in economic administration and local legislative power. In 2010, the Xiamen SEZ was expanded to cover the entire municipality. Today, Xiamen is a modern and international port city.